Can technical analysis guide you through Bitcoin’s September selloff?

Overview

It has been another rollercoaster-ride week for crypto traders, as the prices of bitcoin plummeted to 8200 levels in less than 24 hours, and major altcoins suffered double-digit losses. While the panic levels of the markets have certainly surged, what does this selloff could tell us about? Meanwhile, technical analysis has been one of the popular ways to predict the price directions of cryptocurrencies, however, what’s the importance of applying statistical trend studies into trading after all? Especially when traders deal with an asset class that is still largely unknown to the mass, and such a situation could make technical analysis particularly crucial.

Fear & Greed

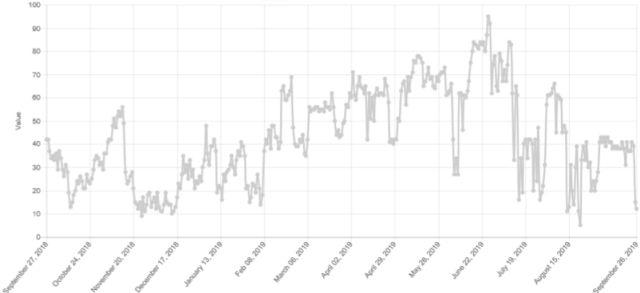

Fear has spread all over the crypto space as the prices of bitcoin nosedived on Wednesday to as low as 7660 before stabilized at around 8300 levels. The Crypto Fear & Greed Index (CFGI) dropped to 15 then 12 (figure 1), which is in the area of “Extreme Fear”, on the second day after the selloff. While “Extreme Fear” can be a sign that investors are too worried, and that could present a buying opportunity, the level of 12 was not lowest and it could go even lower. On August 22, the CFGI dropped to 5 (figure 2) and that’s the lowest in the record. On that day, the prices of BTC plunged from the 10800 levels to around 9800 in a matter of hours.

Figure 1: Fear & Greed Index (Source: Alternative.me)

Figure 2: Crypto Fear & Greed Over Time (Source: Alternative.me)

OKEx’s Long/Short Ratio Raised Red Flags

Although the plunge of the prices of bitcoin seems untraceable, our system has already red-flagged some serious price actions ahead of the selloff.

OKEx’s BTC Long/Short Ratio (figure 3), it shows the ratio of traders across OKEx’s platform with net long vs. net short positions over a given period. When the Ratio goes higher, it indicates that the potential profit of short traders would be higher, and that’s often one of the signs before a selloff could happen. The Ratio surged and stayed at near the level of 2.0 right ahead of the Wednesday selloff. The signal has successfully predicted the selloffs in 11/7 and in early August.

Figure 3: OKEx’s BTC Long/Short Ratio (Source: OKEx)

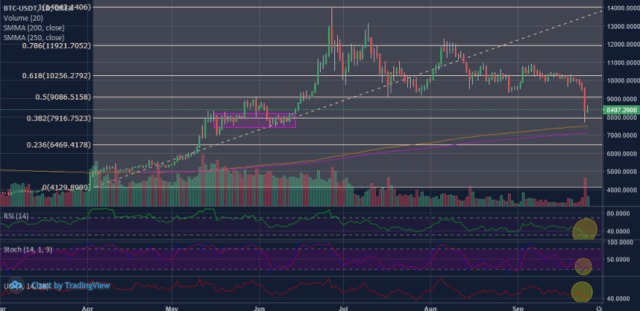

BTC Prices: Short-term Bearish; Long-term Bullish

OKEx Technicals is still cautioned on the short-term outlook of bitcoin but remains bullish for the long-term. We expect to see more consolidations at the current level after the Wednesday selloff, but we believe the first real support is around the 7,500–8,000 area (figure 3), which is the 38.2% Fibonacci retracement, and the consolidation period back in late May and early June, also that’s where the 200 and 250-day moving averages are located.

Additionally, the RSI may suggest bitcoin has already oversold, however, the Stochastic Oscillator and Ultimate Oscillator are not yet oversold, so that could create rooms for the prices of bitcoin move a little lower, before developing a tread reversal. However, this price corrections could create buying opportunities to position for the next major rally.

Figure 4: BTCUSDT Daily Chart (Source: OKEx; Tradingview)

Does Technical Analysis Important at All?

It’s not hard to notice that there were huge among of crypto-related technical analyses on the internet. The fact that short-term or day traders are usually the ones who rely the most on technical analysis, although some of the traders may have misconceptions about its nature and what it can do for them. Most of the traders have been trading in the secondary market, which has always been a zero-sum game. Some new traders find technical analysis useless when they couldn’t profit by employing such practice, however, we shouldn’t neglect the importance of what statistical trend, data, and price information could tell us about, especially when it comes to crypto trading.